Weekly Insights – December 25, 2023

Weekly Market Insights :

Investors Boost Stocks Ahead Of Holiday Week

|

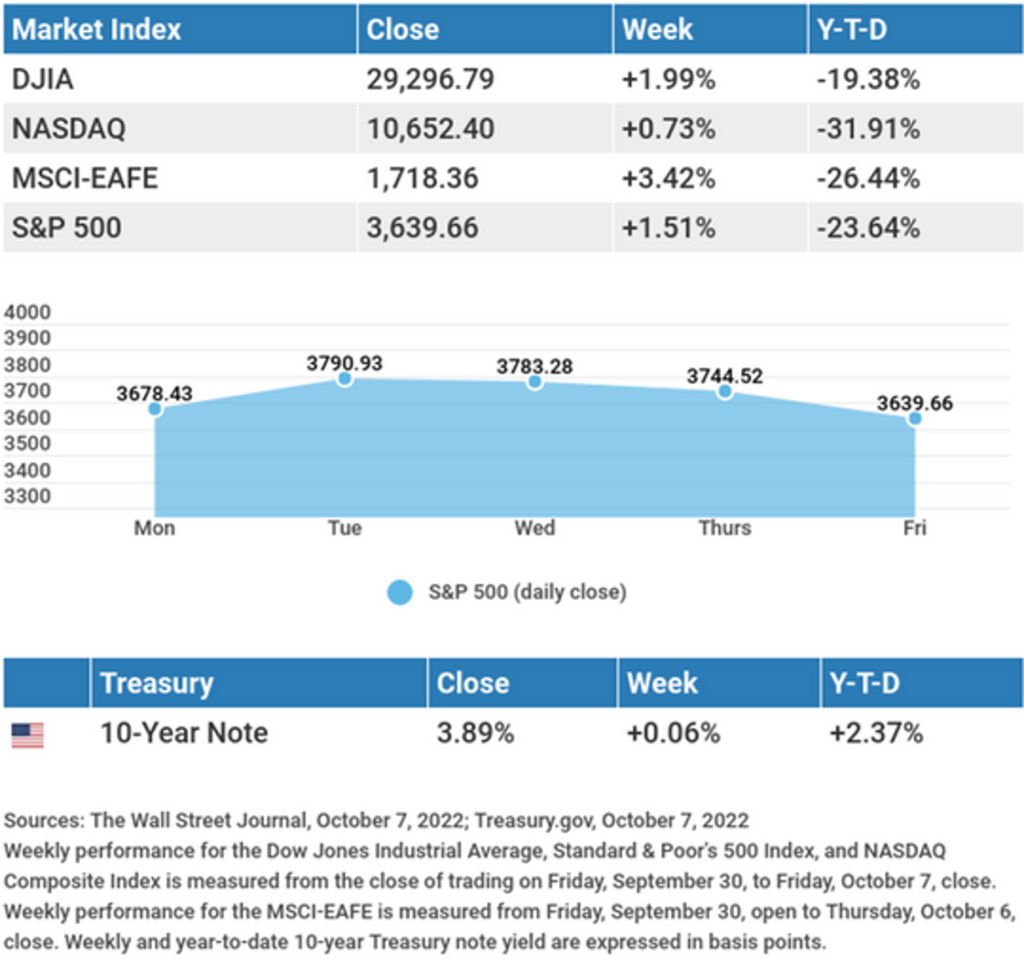

Investor optimism and fears of missing out on future gains propelled stocks higher in the last full week of trading before year-end. The Dow Jones Industrial Average added 0.22%, while the Standard & Poor’s 500 gained 0.75%. The Nasdaq Composite index advanced 1.21% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, added 0.51%.1,2,3 |

|

|

Stocks Build On GainsThe current market narrative of declining inflation, easing interest rates, and better earnings ahead continued to fuel stock market gains, with some of the year’s laggards, such as smaller cap stocks and energy names, leading the way. While the stock market has repeatedly seen gains gather steam in the final trading hours, a late-day sell-off on Wednesday unnerved investors. While it’s difficult to know precisely why, the sharp decline may have resulted from profit-taking and low trading volumes, which can result in unexpected volatility or other technical reasons. Whatever the case, stocks rebounded nicely the following day and Friday. Housing Revival?The housing market struggled this year amid higher mortgage rates and rising home prices. Last week, several housing reports suggested the housing market may be improving. New home construction rose 14.8% in November, reaching levels not seen since May, while existing home sales rebounded 0.8%, reversing five straight months of declines. Existing home sales have been hurt by low inventory since many homeowners with low-rate mortgages are hesitant to move and take on a higher-rate mortgage. This logjam may loosen as 30-year mortgage rates fell from 7.79% at the end of October to 6.95% in mid-November.4, 5 New home sales disappointed, however, falling 12.2%, though they came in 1.4% higher from November a year ago.6 This Week: Key Economic DataThursday: Jobless Claims. Source: Econoday, December 22, 2023 This Week: Companies Reporting EarningsNo companies reporting earnings this week. Source: Zacks, December 22, 2023 |

|

|

“Humor is laughing at what you haven’t got when you ought to have it.” – Langston Hughes |

|

Tax Tips For Those In The MilitaryThe Internal Revenue Service has certain special tax breaks and programs for members of the U.S. Armed Forces.

*This information is not intended to substitute for specific individualized tax advice. We suggest you discuss your specific tax issues with a qualified tax professional. Tip adapted from IRS.gov7 |

|

Stay Healthy During Flu SeasonThis flu season, it’s more important than ever to stay healthy. Fortunately, you may reduce your risk this flu season with a few simple steps.

While this information should not substitute for medical advice from your healthcare provider, implementing better habits, like frequent handwashing, wearing a face mask, and avoiding anyone ill, may help you and your loved ones stay healthy this flu season. Tip adapted from The Centers for Disease Control8 |

|

|

Liz went into a convenience store at 1:58 AM on Sunday to get a coffee. She drove six miles away and then returned to the store to get a lotto ticket, also at 1:58 AM. The store’s clock was working perfectly, so how could it be 1:58 AM again when she returned?

Last week’s riddle: Ray slipped off of a 30-foot escalator and landed on a sidewalk. He was embarrassed, yet uninjured. How could this be? Answer: He slipped off the escalator’s bottom step. |

|

|

|

The hidden beach in Marietas Islands, Puerto Vallarta, Mexico |

Footnotes And Sources

2. The Wall Street Journal, December 22, 2023 3. The Wall Street Journal, December 22, 2023 4. MarketWatch, December 19, 2023 5. Fox Business, December 20, 2023 6. U.S. Census Bureau, December 22, 2023. 7. IRS.gov, October 23, 2023 8. CDC.gov, December 11, 2023 |

|

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2023 FMG Suite. |