Weekly Market Insight – July 18, 2022

Presented by Cornerstone Financial Advisory, LLC

|

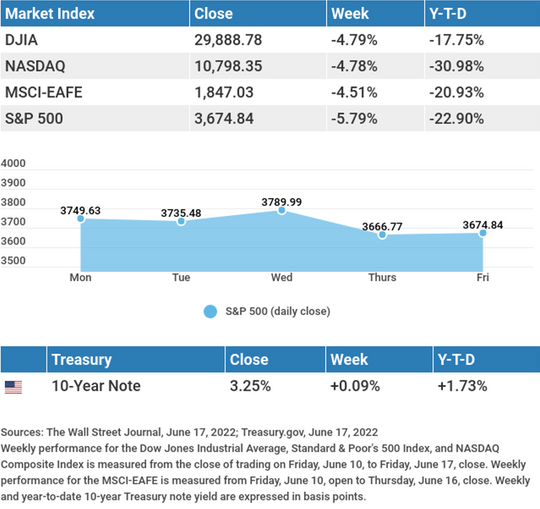

A record-high inflation report, the prospects of a more aggressive Fed, and growing recession fears sent stocks lower– though losses were pared by a Friday rally. The Dow Jones Industrial Average slipped 0.16%, while the Standard & Poor’s 500 lost 0.93%. The Nasdaq Composite index dropped 1.57% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, lost 3.49%. 1,2,3 |

|

|

Stocks SlideAs the week opened, recession fears intensified with reports of renewed Covid-related lockdowns in China. Also, the U.S. dollar continued to climb, reflecting global economic weakness. June’s consumer price index report showed price increases accelerating. Year-over-year prices jumped 9.1%, the fastest pace in over 40 years. Speculation grew that the Federal Reserve might contemplate a 100 basis point increase in short-term rates later this month, rather than the 75 basis point hike it earlier signaled. The market rebounded on Friday following comments by an Federal Open Market Committee member who said he favoring a 75 basis point hike. Also helping the Friday rally was a strong retail sales report and additional second-quarter company reports.4 Dollar StrengthThe increasing strength of the U.S. dollar moved to center stage last week as the dollar index (a measure of the U.S. dollar to six other major currencies) reached a fresh high, while the euro fell to parity with the dollar and to its lowest level since 2002. 5 A rising U.S dollar hurts overseas profits when converted into dollars and it also makes U.S. products and services more expensive. It’s a challenge for large, multinational companies that derive a portion of their earnings from overseas markets. Greater insight into the extent of that impact may be gained as companies provide forward guidance with their upcoming reports. This Week: Key Economic DataTuesday: Housing Starts. Wednesday: Existing Home Sales. Thursday: Jobless Claims. Index of Leading Economic Indicators. Friday: Purchasing Managers’ Index (PMI) Composite Flash. Source: Econoday, July 15, 2022 This Week: Companies Reporting EarningsMonday: Bank of America (BAC), International Business Machines (IBM), The Goldman Sachs Group (GS), The Charles Schwab Corporation (SCHW) Tuesday: Netflix, Inc. (NFLX), Johnson & Johnson (JNJ), J.B. Hunt Transport Services, Inc. (JBHT) Wednesday: Tesla, Inc. (TSLA), Abbott Laboratories (ABT), CSX Corporation (CSX), United Airlines Holdings, Inc. (UAL) Thursday: AT&T, Inc. (T), Snap, Inc. (SNAP), Blackstone, Inc. (BX), American Airlines Group, Inc. (AAL), Union Pacific Corporation (UNP), D.R. Horton, Inc. (DHI) Friday: Verizon Communications, Inc. (VZ), Schlumberger Limited (SLB), American Express Company (AXP), NextEra Energy, Inc. (NEE), PPG Industries, Inc. (PPG) Source: Zacks, July 15, 2022 |

|

|

“When you come to the end of your rope, tie a knot and hang on.” – Franklin Delano Roosevelt |

|

Recovering Documents Following a Natural DisasterIf you live in an area that’s prone to natural disasters, it’s important to be prepared by knowing how to manage your important documents and paperwork, and by knowing what to do if those materials are lost. Here are some tips from the IRS:

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional. Tip adapted from IRS.gov6 |

|

Everything You Need to Know About Walking MeditationYou’ve likely heard about sitting meditation, where you’re encouraged to find a comfortable place to sit or lay down, but have you ever heard of walking meditation? Walking meditation follows similar principles to sitting or lying meditation, but instead of staying in the same place, you direct your focus to your footsteps and the experience of walking. The goal is to be mindful of every step and experience something that we usually do automatically. You can focus on the mechanics of each step, your breathing, or the sights and smells on your walk. And you don’t have to walk far to enjoy the benefits! A quick, 10-minute walk will leave you more focused, mindful, and centered. Tip adapted from Greater Good in Action at Berkeley7 |

|

|

You have 9 seemingly identical cubes before you. You are told that one is heavier than the other eight. Using a two-pan balance scale only twice, how can you pick out the heaviest cube? Last week’s riddle: Two in every corner, one in every room, none in a house. What is it? Riddle answer: The letter “R.” |

|

|

| Licancabur Volcano, Atacama desert, Chile |

Footnotes and Sources

2. The Wall Street Journal, July 15, 2022 3. The Wall Street Journal, July 15, 2022 4. The Wall Street Journal, July 13, 2022 5. CNBC, July 11, 2022 6. IRS.gov, May 16, 2022 7. Berkeley.edu, May 26, 2022 |

|

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite. |