Weekly Market Insights | December 23rd, 2024

Weekly Market Insights | December 23rd, 2024

Powell Signal Leaves Investors Cold

Stocks were under pressure last week as the Fed Chair’s hawkish comments unsettled investors ahead of the holiday season.

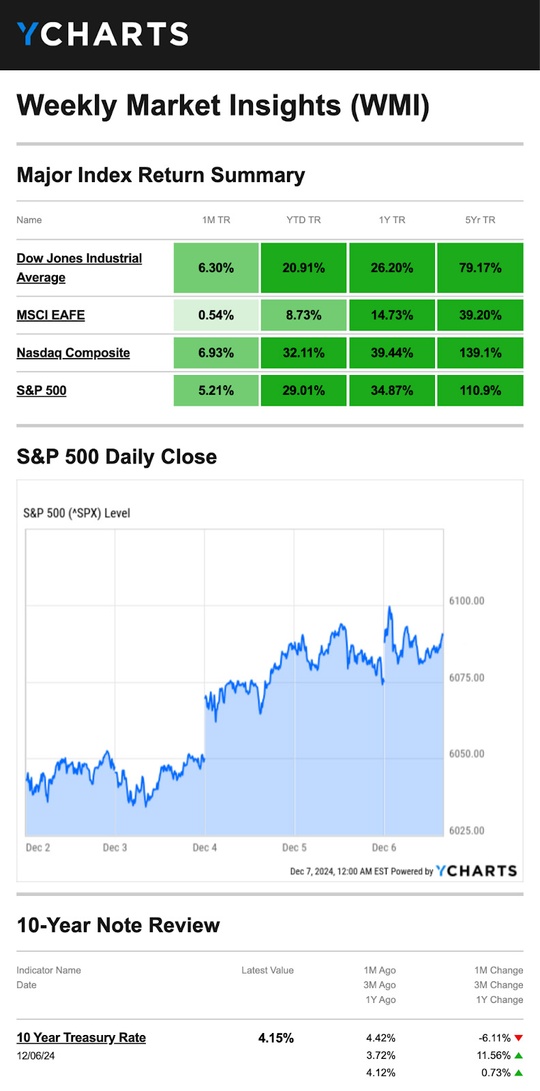

The Dow Jones Industrial Average received the hardest hit, falling 2.25 percent. The Standard & Poor’s 500 Index lost 1.98 percent, while the Nasdaq Composite Index dropped 1.78 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, retreated an eye-catching 3.38 percent.1,2

No Santa Yet

Divergence marked the start of the week as megacap tech stocks rallied while the Dow Industrials fell for the eighth-straight session—its longest losing streak since 2018.3

Following its scheduled December meeting, the Fed announced it was cutting short-term rates by a quarter point, as widely expected. However, Fed Chair Jerome Powell also signaled fewer rate reductions next year. “From here, it’s a new phase and we’re going to be cautious about further cuts,” he said in his post-meeting news conference.

The rate news surprised investors, who were anticipating more dovish comments from the Fed Chair.4,5

Markets were under pressure again early Friday as the spending bill to fund the federal government appeared to stall. But a lower-than-expected inflation update boosted the market and helped erase some of the earlier losses.6,7

Source: YCharts.com, December 21, 2024. Weekly performance is measured from Monday, December 16, to Friday, December 20. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Holiday Cheer

Despite a difficult week, stocks are on track to have their second consecutive year of double-digit returns. Year to date, through Friday’s close, the S&P 500 was ahead by about 24 percent. In 2023, the S&P 500 also tacked on 24 percent for the full year.8

This Week: Key Economic Data

Monday: Consumer Confidence.

Tuesday: Durable Goods. New Home Sales.

Wednesday: Stock market closed.

Thursday: Weekly Jobless Claims. Fed Balance Sheet.

Friday: International Trade in Goods.

Source: Investors Business Daily – Econoday economic calendar; December 16, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

No companies are scheduled to report results this week.

Source: Zacks, December 16, 2024. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

“Life shrinks or expands according to one’s courage.”

– Anaïs Nin

Tax Tip…

What is the Lifetime Learning Credit?

The Lifetime Learning Credit (LLC) is a tax credit for qualified tuition and related expenses. It can help pay for undergraduate or graduate studies and courses to acquire or improve job skills. The credit is worth up to $2,000 per tax return.

Another thing about this tax credit is that it’s available for unlimited tax years, unlike the American opportunity tax credit which is only for the first four years at an eligible institution.

To claim the LLC, you must pay qualified education expenses for higher education and enroll at an eligible educational institution. Check out the IRS guidelines for more details and to see whether you may qualify.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS9

Healthy Living Tip…

How to Make a Healthy Cup of Joe

We have good news for all you coffee drinkers out there! There are many ways to make your cup of Joe in the morning a little healthier so you can feel good about your morning routine.

Here are some things to remember next time you make a cup of coffee:

- Be wary of adding too much sugar to your coffee. If you like your coffee sweet, use a natural sweetener like stevia, cinnamon, honey, or agave.

- When possible, choose organic coffee. Organic coffee is less likely to have been sprayed with synthetic pesticides. Also, shop for local coffee beans if possible!

- Avoid drinking too much coffee and drinking coffee after 2 p.m., as it may affect your sleep cycle.

Coffee is one of the most popular drinks in the morning, and it’s not all bad. Just be aware of what you put in your coffee, how much you drink, and when.

Tip adapted from Healthline10

Weekly Riddle…

It softly goes up and down the stairs in many homes and office buildings, yet it never moves. What could it be?

Last week’s riddle: It is in seconds, seasons, centuries, and minutes, but you won’t find it in years, decades, or days. What is it?

Answer:The letter N.

Photo of The Week…

Red Fox

Algonquin Provincial Park, Ontario, Canada

Footnotes And Sources

1. The Wall Street Journal, December 20, 2024

2. Investing.com, December 20, 2024

3. CNBC.com, December 16, 2024

4. CNBC.com, December 17, 2024

5. The Wall Street Journal, December 18, 2024

6. CNBC.com, December 19, 2024

7. CNBC.com, December 20, 2024

8. The Wall Street Journal, December 20, 2024

9. IRS.gov, January 10, 2024

10. Healthline, August 1, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.