Weekly Market Insights – May 8, 2023

Friday Rally Trims Losses; CPI Report Next Week

Presented by Cornerstone Financial Advisory, LLC

|

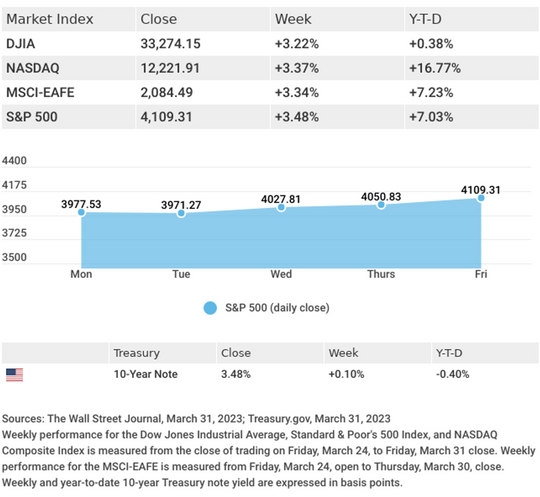

A Friday rebound, triggered by a big tech company’s earnings beat and a strong jobs report, shaved much of the week’s accumulated losses. The Dow Jones Industrial Average fell 1.24%, while the Standard & Poor’s 500 lost 0.80%. The Nasdaq Composite Index was flat (+0.07%) for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.62%.1,2,3 |

|

|

Stocks See-SawRenewed regional bank concerns weighed on investor sentiment last week, despite the rescue of a troubled bank before the start of the trading week. But worries were not isolated to regional banks. Secretary of the Treasury Janet Yellen commented that the federal government may hit its debt ceiling earlier than expected, heightened investor jitters over a potential technical default. The stock market also slipped in the wake of the latest rate hike decision by the Federal Open Market Committee (FOMC). Solid earnings from one mega-cap tech firm and a strong employment report steadied investors, resulting in a Friday bounce that ended a volatile week on a positive note. Fed Hikes RatesAmid concerns in the regional bank sector and tightening credit conditions, the Fed elected to increase interest rates by 0.25%, citing elevated inflation and robust job gains. Investors were more focused, however, on what the Fed signaled about its plans since the expected rate hike. The Fed indicated it may pause further rate hikes, suggesting that future decisions will be based on economic data and prevailing financial conditions. Following the announcement, interest rate traders assigned an 89% probability that rates would remain unchanged following the next meeting of the FOMC in June.4, 5 This Week: Key Economic DataWednesday: Consumer Price Index (CPI). Thursday: Producer Price Index (PPI). Jobless Claims. Friday: Consumer Sentiment. Source: Econoday, May 5, 2023 This Week: Companies Reporting EarningsMonday: PayPal Holdings, Inc. (PYPL), Skyworks Solutions, Inc. (SWKS), KKR & Co., Inc. (KKR) Tuesday: Air Products and Chemicals, Inc. (APD) Wednesday: Occidental Petroleum Corporation (OXY), The Walt Disney Company (DIS) Source: Zacks, May 5, 2023 |

|

|

“If we would build on a sure foundation in friendship, we must love friends for their sake rather than for our own.” – Charlotte Brontë |

|

Need Last Year’s Tax Returns?Help is available for taxpayers who need tax information for prior years but who did not keep copies of their returns. There are ways to get the information you need. Keep in mind the Internal Revenue Service (IRS) recommends that taxpayers keep copies of their returns and any documentation for at least three years after filing:

Tip adapted from IRS.gov6 |

|

Being SMART About Fitness GoalsAre you putting exercise on the back burner? Make it a priority. To stick with a workout regimen, make regular physical activity one of your priorities. Here’s where setting SMART goals can help. Instead of saying you will “exercise more,” state a SMART exercise goal. SMART stands for: Specific: State the objective you wish to meet as precisely as possible: “I am going to commit to doing a full-body video workout several times a week.” Measurable: Identify quantifiable criteria to allow you to measure your progress: “I am going to do this workout three times a week for at least 30 minutes each time. I will track my progress in my workout journal.” Attainable: Your goal should be ambitious but not impossible: “I am committing to three times a week, not seven times a week, because it is realistic and achievable for me with my current schedule.” Relevant: Your goals must align with your current circumstances and priorities: “I will do it to stay healthy and strong during these times and to feel less stressed.” Time-bound: Allocate a specific period for completing your goal: “I will commit to this plan for a month. In 30 days, I will have had 12 workouts and will reassess my goal after that.”

|

|

|

I may be red, green, or yellow. Eat me, and you may stay a healthy fellow. My interior is white; I don’t give off light. What am I?

Last week’s riddle: Two sailors stand on opposite sides of a boat. One looks west, and the other looks east – yet, they can both see each other clearly. How can this be? Answer: The sailors are looking inward (into the boat) while standing with their backs against the ship’s sides. |

|

|

| Aurora Borealis, Lofoten islands, Norway |

Footnotes And Sources

2. The Wall Street Journal, May 5, 2023 3. The Wall Street Journal, May 5, 2023 4. The Wall Street Journal, May 3, 2023. 5. CMEGroup.com, May 3, 2023 6. IRS.gov, 2023 7. Cleveland Clinic, February 7, 2023 |

|

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2023 FMG Suite. |