Weekly Market Insight – November 14, 2022

Weekly Market Insights: Cooling Inflation Brings Market Gains

Presented by Cornerstone Financial Advisory, LLC

|

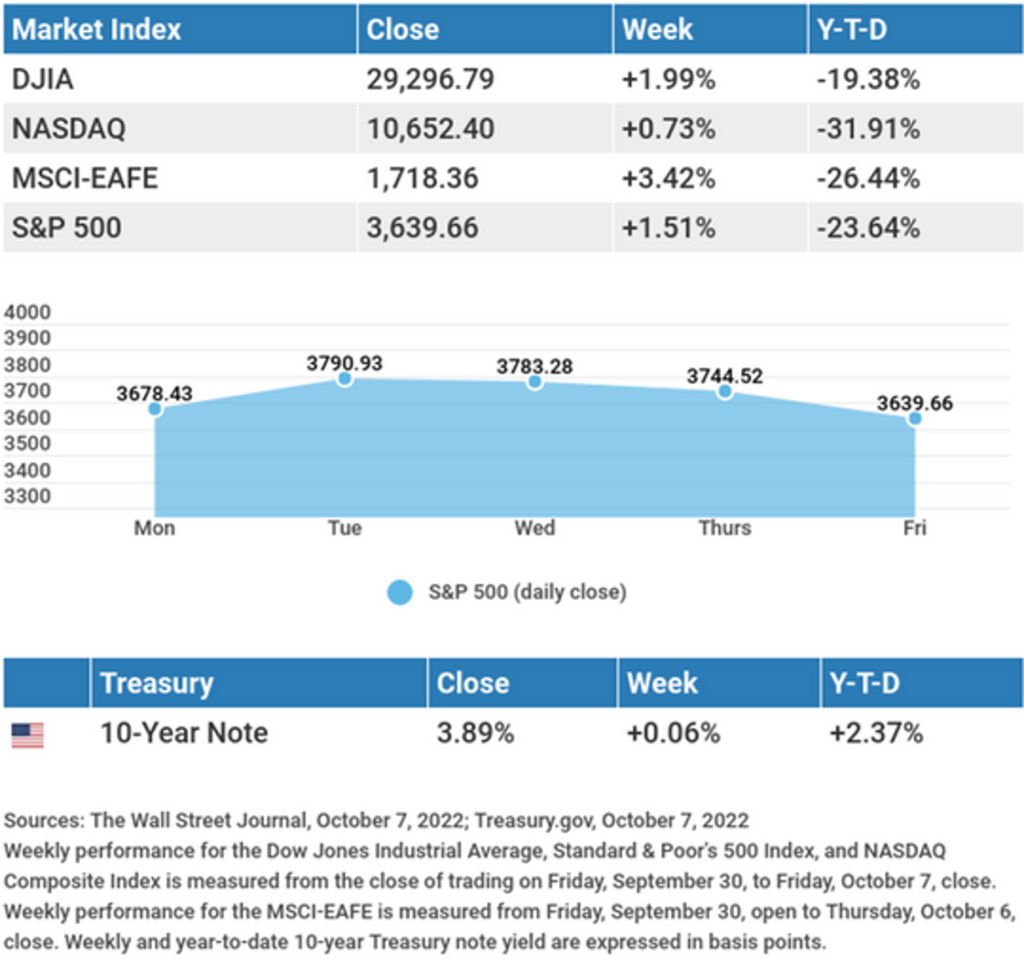

A cooling inflation number ignited a powerful rally on Thursday, sending stocks to strong gains for the week. The Dow Jones Industrial Average gained 4.15%, while the Standard & Poor’s 500 added 5.90%. The Nasdaq Composite index rose 8.10% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, picked up 5.72%.1,2,3 |

|

|

Stocks SurgeA lower-than-expected inflation report triggered the biggest one-day stock market gain in more than two years as the news raised investors’ hopes that the Fed might consider easing the pace of future rate hikes. The day’s gains were pronounced in the hard-hit technology sector, as the tech-heavy Nasdaq added 7.35%.4 Stocks initially rallied to start the week, but gave up some of the gains on Wednesday following a muddy and indecisive outcome to the midterms. Friday saw stocks build on their gains to close out an exceptional week. Inflation ModeratesConsumer prices rose slower in October, increasing 0.4% for the month and 7.7% from 12 months ago. Both numbers were below market expectations of 0.6% and 7.9%. The core CPI (excludes energy and food sectors) rose a more modest 0.3% on a monthly basis and 6.3% from a year ago.5 The deceleration in prices was mainly attributable to price declines in used cars (-2.4%), apparel (-0.7%), and medical care services (-0.6%). Despite the progress, inflation remains well above the Fed’s 2% target rate. A look behind the numbers shows that October’s 7.7% CPI was fueled by the largest monthly jump in shelter costs since 1990 (+0.8%). Shelter costs account for one-third of the CPI. Energy was up 1.8%, while food costs rose 0.6% for the month.6 This Week: Key Economic DataTuesday: Producer Price Index (PPI). Wednesday: Retail Sales. Industrial Production. Thursday: Housing Starts. Jobless Claims. Friday: Existing Home Sales. Index of Leading Economic Indicators. Source: Econoday, November 11, 2022 This Week: Companies Reporting EarningsMonday: Tyson Foods, Inc. (TSN). Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD). Wednesday: Nvidia Corporation (NVDA), Cisco Systems, Inc. (CSCO), Target Corporation (TGT), Lowe’s Companies, Inc. (LOW), The TJX Companies, Inc. (TJX). Thursday: Applied Materials, Inc.(AMAT), Palo Alto Networks, Inc. (PANW), Ross Stores, Inc. (ROST). Source: Zacks, November 11, 2022 |

|

|

“To expect truth to come from thinking signifies that we mistake the need to think with the urge to know.” – Hannah Arendt |

|

Meet The Taxpayer Advocate ServiceDid you know that an independent organization within the IRS is fighting for your rights as a taxpayer? The Taxpayer Advocate Service (TAS) protects taxpayers’ rights by ensuring that all taxpayers are treated fairly and know and understand their rights under the Taxpayer Bill of Rights. Here are some things to know about TAS:

Tip adapted from IRS.gov7 |

|

What Is Compostable?Composting is a great way to go green and keep more waste out of landfills that don’t need to be there. Composting has many benefits, including waste management and reduction, soil enhancement, reduction of greenhouse gasses, and many more. Plus, composting doesn’t have to be hard! Let’s break down what is compostable to help you understand where to start. There are two types of compostable waste, green and brown:

Tip adapted from Sustainable Jungle8 |

|

|

I’m usually standing on a city sidewalk, and I’ll always stand by your car. But if you don’t feed me, you may get into trouble. What am I? Last week’s riddle: Create a 13-letter word using all 13 of the following letters: O A I I S T T R R D N A M. Answer: ADMINISTRATOR. |

|

|

|

Preening flamingo, Galapagos Islands, Ecuador. |

Footnotes And Sources

2. The Wall Street Journal, November 11, 2022 3. The Wall Street Journal, November 11, 2022 4. CNBC, November 10, 2022 5. CNBC, November 10, 2022 6. CNBC, November 10, 2022 7. IRS.gov, July 19, 2022 8. Sustainable Jungle, August 8, 2022 |

|

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite. |